The Failure and Forgotten Stories in Online Vertical Platforms

15 min read

Hi, I am Jonathan Hayashi. After graduating from University of Rochester with double degrees in Optical Engineering and Financial Economics, I worked in one of the top 3 investment banks in Japan, SMBC Nikko. Later on, I joined one of the largest VC firms in Japan, SBI, and took charge of growth stage investments in Blockchain, Fintech, and AI Sector. I joined Cornerstone Ventures in 2020.

China Internet Unicorn Part I and Part II:

- For the full list of all the Chinese companies that became unicorns between 2014 and 2020, please go to Part I.

- “All I Want To Know Is Where I’m Going To Die, So I’ll Never Go There”

— by Warren Buffet & Charles Munger - For this article, which would be Part II of this series, we will look into the failed online platforms in some verticals in China, including real estate, automobile, fashion, cosmetics, books, 3C, etc., to learn from their mistakes.

- Part II Content Table:

- Background of general EC in China

- Vertical: Real Estate

- Vertical: Automobile

- Vertical: Famously Failed Vertical ECs

Background of general EC in China:

- 8848

-

-

- The first B2C ecommerce in China. Started as a division under a software company and spun out in 1999.

- Had some successful early traction, but shut down at around 2003 due to lack of funding, logistic infrastructure, and internal management issues.

-

- ebay

-

-

- Ebay entered China in 2003 by acquiring a local EC EachNet (易趣), which was established in 1999.

- Failed due to slow connection (as eBay transfers EachNet’s server to US), fierce competition from Alibaba/Taobao, and other issues. Ebay sold EachNet in 2012 and left China.

-

- Amazon

-

-

- Amazon entered China in 2004 by acquiring a local EC Joyo (卓越網), which was established in 2000 by famous software company Kingsoft (金山).

- Failed due to lack of localization (as Amazon did not allow local teams to make much decision). Amazon announced in 2019 to stop serving Chinese merchants and only operates as a cross-border EC to sell foreign goods in China.

-

- Paipai (拍拍網)

-

-

- A C2C E-commerce established in 2005 by Tencent to compete with Alibaba’s Taobao and eBay’s EachNet.

- As a late comer, Paipai gained some traction by leveraging Tencent’s social media users, but couldn’t scale up due to fierce competition of price coming from Taobao, and bad operation which resulted in delivering scandals of fake and low-quality products.

- Below is the market share of C2C E-commerce in China, where red is eBay’s Eachnet, white is Tencent’s Paipai, and yellow is Alibaba’s Taobao.

- In 2014, Tencent invested in JD, forms partnership with it, and sold Paipai to JD at the same time.

-

- Alibaba/Taobao (阿里巴巴/淘寶)

-

-

- Established in 1999 as a B2B E-commerce by Jack Ma. Received $20M investment from SoftBank in 2000, achieved positive cashflow in 2002.

- Established C2C E-commerce Taobao in 2003, released AliPay in 2004, acquired Yahoo China in 2005, started B2C E-commerce T-mall in 2008.

- Went public in HK in 2007, went private in 2012, and got listed on NYSE in 2014.

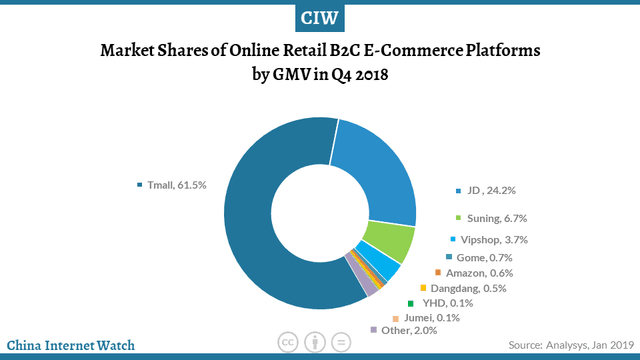

- The absolute number one player in China E-commerce. As a group, Alibaba occupies 50~60% market share of online retail. Below is the market share of online retail in China.

-

- JD (京東)

-

-

- Established in 1998 as an offline retailer by Richard Liu and started EC business in 2004.

- Transformed into a B2C EC with a focus on 3C (computer, communication, and consumer electronics) products. Unlike Taobao as a platform open to individuals and small firms, JD chose to be a direct sales platform sourcing from branded suppliers, with its strength in self-own logistics and well controlled quality of service and products.

- It is the number two player in China with about 20% market share. Below is the market share of B2C E-commerce.

-

- Pinduoduo (拼多多)

-

-

- Established in 2015/9 by Colin Huang as a late comer in China E-commerce scene.

- Grew quickly with its gamification, group-buying model, social commerce, unique targeting on rural area, and other factors.

- Now the number three player in China.

-

China Internet Unicorn Vertical: Real Estate

-

- Media:

- Before 2000: Real estate industry was blooming and houses just sold themselves. House-buyers rushed into the offline agents’ stores.

- 2000 ~ : Internet started to bloom in China. Real estate companies and agents considered it as an advertisement channel. At that time, many Media E-commerce emerged, where the largest players were Fang.com (房天下, NYSE: SFUN), Sohu Focus (搜狐焦點, acquired by Sohu, NASDAQ: SOHU), E-House (易居, NYSE: EJ), and Anjuke (安居客, acquired by 58.com, NYSE: WUBA).

- These Media Ecommerce companies charge property sellers for posting real estate deals on their websites.

- Online transaction:

- 2008 ~ : Leju (樂居, NYSE: LEJU), which was spun out of Sina (新浪, NASDAQ: SINA) was one of the first Chinese companies that actually allowed users to complete real estate transactions online and released mobile app version of its real estate E-commerce.

- 2011: Pan Yishi (founder of one of the largest real estate developers in China) and Zhou Xin (founder of E-House) met at a forum. One month later, they put 11 units up for an online auction with a zero starting price, which became a hot news in the nation.

- The largest real estate developers all jumped on this bus and started selling some property units online, with attractive discounts and terms.

- At this stage, online sales of real estate were still mainly considered a way to create buzz. E-commerce only occupied an extremely small portion of the real estate market. On the other hand, it became harder and harder to sell real estate, as GDP growth rate in China stopped accelerating.

- Mobile E-commerce and O2O (Online-to-Offline):

- 2012 ~ : With FangDD (房多多, NASDAQ: DUO) as the pioneer, followed by Haowu (好屋中國) and Tops Tech (房產銷冠) , a new trend in real estate EC emerged, which is providing smartphone-app tools to enable real estate agents (who used to focus on selling “second-hand” houses) to sell new houses.

- The revenue model changed too. Instead of charging real estate developers per listing, they charge a commission fee based on the value of transactions they help complete, and then share with agents who brokerage the deals.

- By providing services thru app, they created the real Online-to-Offline experience in real estate transactions.

- The War of Capital

- 2014 ~ : The market was overheated due to fierce competition. Started with Qfang.com (Q 房網, rescued and acquired by Guochuang in 2017), — who copied FangDD’s model, offered higher revenue share to the agents, and acquired lots of agents itself, — many players entered the market.

- That includes Iwjw (愛屋吉屋, shut down in 2019), which was founded by a team from a VC backed ride hailing business (which had a decent M&A exit) and operated both house-rental and house-buying platforms. Iwjw failed after burning $350M by

- hiring tons of agents,

- offering super high base salary to agents,

- charging super low commission fee from transactions,

- deploying massive marketing campaigns, and

- waiving rent or down payment partially.

- The traditional real estate agents, like LianJia (鏈家) and 5i5j (我愛我家), were launching their internet arms to compete with these startups too.

- The general EC, like Taobao, also sold quite amount of houses by putting them up for online auction. Yet, the volume was relatively small.

- Needless to say, VC and PE funds were the ones providing the capital for this war.

- Coming out the other side: Cooperation and VR

- 2017 ~:The war of capital was over. Startups were shutting down or getting sold. That was when Beike (貝殼, NYSE: BEKE) came out, under the traditional agent LianJia.

- Officially launched in 2018/4, Beike is a platform that enables real estate agents to transact second-hand property, new property, and rental property. Its revenue in 2018 and 2019 were $4.2B and $6.8B, with an estimated revenue of $7.8B for 2020. It achieved this mostly due to two innovation: cooperation model and VR technology.

- Cooperation: Beike breaks down the job of an agent during a transaction into 10 different parts (ex. House listing, document administration, lead generation, etc), allows different agents to take charge of different parts, and shares the revenue accordingly.

- VR: House buyers can check the inside views of the houses by watching the VR version of them.

- Media:

China Internet Unicorn Vertical: Automobile

- Media

-

-

- 2005 ~ : Just like real estate industry, auto industry viewed Internet as an advertisement channel in the beginning. The winner of this race is Autohome (汽車之家, NYSE:ATHM), on which users can find all kinds of automobile related information and car dealers can throw in ads.

- Authome, a last mover established in 2005, beat its competitors like PCauto (太平洋汽車, est. 2002), Sohu Auto (搜狐汽車, ets. 2000), 51 Auto (51 汽車, est. 2005) and BitAuto (易車網, est. 2000) with incomparably great quality and large quantity of content.

-

- Online Transaction

-

-

- 2010 ~ : EC giant Taobao partnered with Mercedes-Benz to start gradually educating the market to consider buying cars online.

- 2013/11/11: 11th November has always been the big day for Chinese EC. On 2013, the giants EC in auto industry like Autohome, BitAuto, Sohu Auto and Alibaba’s T-mall came together and sold 180,000 new cars in one day, which sent a great signal to both the capital market and the consumer market.

- Yet, consumers still prefer to go to offline stores due to multiple reasons. For example, they’d like to physically touch the cars and test drive; many online payment methods couldn’t handle such expensive purchase.

-

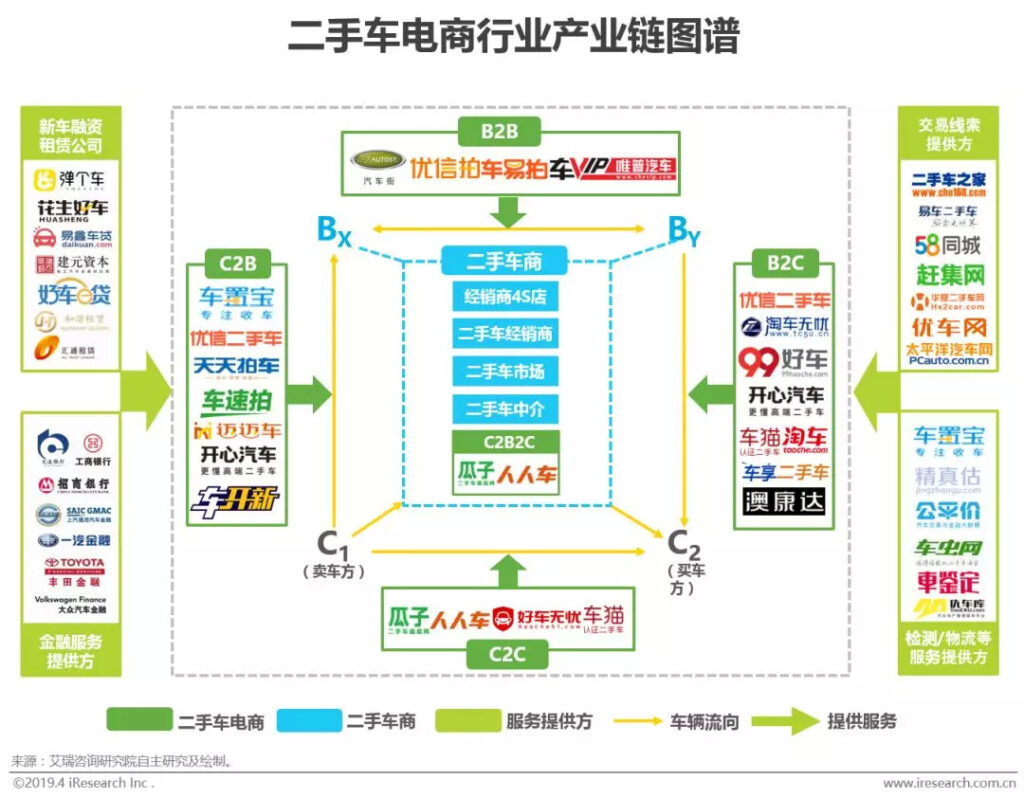

- Major players in different kinds of models: C2C, C2B2C, B2C, B2B2C, C2B, B2B

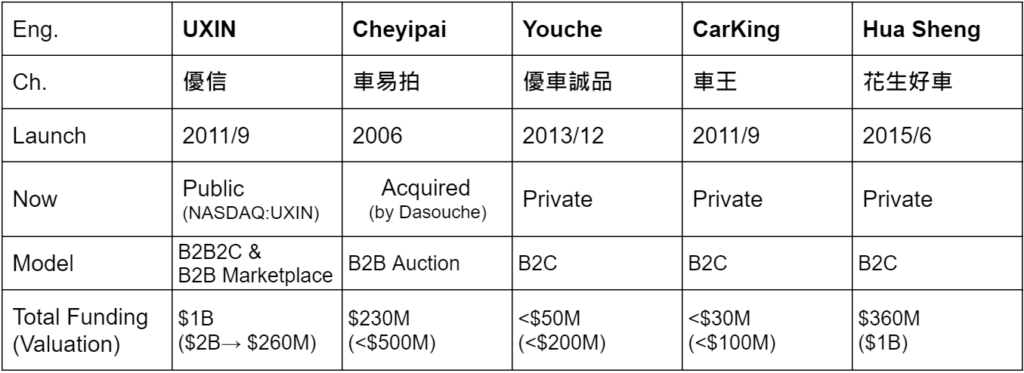

- B2C / B2B2C / B2B

-

- B2B is the first successful model in this vertical.

- These companies act as wholesaler, importing cars from car manufacturers and selling them to individuals or car dealers/retailers.

- UXIN is the only player among the China Internet unicorns in auto industry to get listed and has enough bargain power to operate a B2B2C model, without purchasing the cars upfront.

- Hua Sheng, similar to Dasouche’s Tangeche service, sells car in a financial leasing model,

-

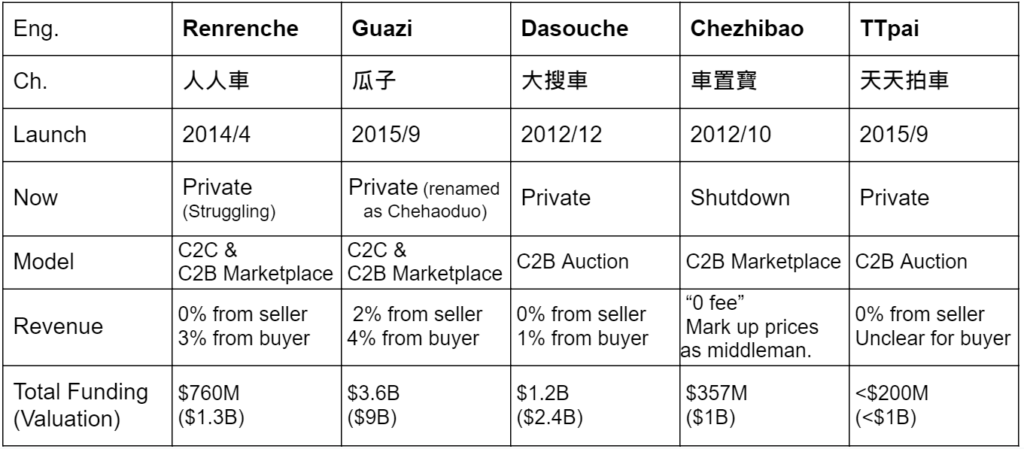

- C2C / C2B

-

- “B” in these cases are car dealers/retailers.

- All of these companies provide physical car inspection and price estimation service within 1~2 days after inspection, and secure buyers within days or even hours.

- As the US pioneer of C2C second-hand car EC Beepi announced bankruptcy in 2016, all players in China pivoted to heavier-asset model, which is to operate their own physical car sales centers and sell cars in B2C model.

-

- B2C / B2B2C / B2B

- The failed challengers

-

- The first movers that were established before 2010 in a premature market:

- GuChe (估車網), ShuaiChe (帥車網)

- The C2C platforms that couldn’t raise enough funding to wait through the long sales cycles

- 2 Souche (2 搜車), Old2New (以舊換新網), CCcar (CC 車), Maocar (貓卡)

- The B2C players that couldn’t gain much bargain power over offline dealers

- Maimai (麥麥車), Taoche (淘車之家), Niwo (你我車平台), Kaka (卡卡二手車), Mr. Che (車先生), D+ (迪加用車網), Kaola (考拉車)

- The C2B players that chose the best business model for car E-commerce and raised some funding, but lost in fierce competition.

- PAHaoche (平安好車), CLCW (車來車往)

- The first movers that were established before 2010 in a premature market:

China Internet Unicorn Vertical: Famously Failed Vertical ECs

- Fashion

-

- Vancl (凡客)

- Established in 2007, this China Internet unicorn had raised more than $400M with its peak valuation at $3B. At its prime time from 2009 to 2012, it hired more than 13,000 employees and sold 30M clothes per year. It was the fouth largest B2C Ecommerce in China at the time, behind JD, Amazon China, and Dangdang.

- Vancl designed, manufactured, and sold its own fashion items. Its price was much lower than offline stores, and it supported COD payment in more than 1,100 cities, while also allowed refund within 30 days.

- Now it has only less than 200 employees and there is rumor that it will be shutting down soon.

- Major factors of failure

- Vancl tried to copy JD and become a general EC by expanding to other categories. Yet, with poor execution, it just ended up producing lots of unsold inventory.

- Vancl aggressively deployed many unsuccessful yet expensive advertisement campaigns.

- High-quality affordable brands like ZARA and UNIQLO started to set up more stores in China.

- The last straw broke the camel’s back was placed in 2014, when government announced that 30% of Vancl’s product did not match the basic quality requirements. Since then, Vancl’s reputation of “low-price high-quality” just turned into “cheap”.

- Vancl (凡客)

- Cosmetics

- Lefeng (樂蜂網)

- Founded by a celebrity anchorwoman in 2008, this China Internet unicorn was one of the first vertical EC focused on cosmetic products. It developed its own cosmetic brand and was one of the first ECs to explore KOL marketing. At its peak, its annual revenue was above $400M.

- Lost to fierce competition with a late comer, Jumei (聚美優品, NYSE: JUMEI), Lefeng was acquired by the largest flash-sale discount EC VIP.com (唯品會, NYSE: VIPS) for $112M in 2014.

- Major factors of failure:

- It had too much resource from the beginning, from capital to media exposure and network. And because of this, it didn’t hustle like Jumei did.

- It could not successfully build a good reputation for its own cosmetic brand.

- Tiantian (天天網)

- Founded by cosmetic expert in 2008, it was also one of the first in this industry. Its peak annual revenue was around $160M and got listed on OTC market NEEQ in 2015. Yet, it shut down in 2017 due to fierce competition and cumulative net loss.

- Jumei (聚美優品, NYSE: JUMEI)

- Established in 2010, this China Internet unicorn quickly became the number one EC in the cosmetics vertical, whose GMV was twice of the second player, Lefeng. It went public on NYSE in 2015, with a peak market cap of $5.6B. However, now it has completed lost its market share and its market cap has dropped to below $400M.

- What Jumei did right:

- Jumei could not attract much funding in the beginning. Thus, it had a company culture of saving cost.

- Unlike Tiantian and Lefeng, Jumei operates in a group buying model. Also, Jumei focused on content marketing on social media like Wechat, and instead of relying on other KOL, CEO of Jumei was active on TV shows and became a KOL himself.

- Major factors of failure:

- Jumei faced fierce competition coming from general EC like JD and Taobao as well as upcoming social media Ecommercel like Xiaohongshu.

- The company culture of saving cost was a great thing in the beginning, but that also led to the last straw that broke the camel’s back: its former employee exposed that Jumei had been selling fake and low-quality products.

- Lefeng (樂蜂網)

- Books

- DangDang (當當)

- Incubated by major publisher and VC firms in 1999 as a online book retailer, DangDang occupied 40% of B2C online sales in China in 2004. It rejected the $200M acquisition offer from Amazon and got listed on NYSE in 2010. At its peak in 2010, DangDang sold $1.5B of books annually.

- Things started to change from 2010, when JD launched its book category and DangDang started to expand to others. With its strength in logistics and capital, JD offered one-day delivery and 20% cheaper price. On the other hand, DangDang relied on third-party logistics and rejected investment offers from Baidu and Tencent, and Tencent turned around to invest $215M into JD.

- DangDang has not ceased operation yet. However, it already delisted itself in 2016 and became a small online book seller on T-mall. Recently, the founder’s son is suing his father, which is another longer story…

- Major factors of failure:

- Founders are too profit-driven, that they focused too much on short term net profit.

- Founders wanted too much control over the company, that they rejected the good money and partners. It’s probably because the founders are married to each other and they consider this a family business.

- DangDang did not realize the importance of logistics.

- DangDang only had the team that was good enough to sell books, the easiest product to handle.

- DangDang (當當)

- Online Department Store

- Mecox Lane (麥考林, NASDAQ: MCOX)

- Incubated by Warburg Pincus in 1996 and heavily backed by Sequoia (which held 63% as of IPO), Mecox Lane was the first Chinese B2C Ecommerce to went public in US, whose market cap reached $989M on the first day.

- Targeting at female shoppers, it offered a wide selection from apparel to home products. It was the only company in China with the following three sales channels: Internet, physical stores, and phone+mail order. The year it went public, 2010, was the peak time of its revenue, net profit, and valuation. It generated $227M of revenue and $4M of net profit in 2010, but it never made a profit ever since.

- It went private in 2016 at a valuation of approximately $200M.

- Major factors of failure:

- Mecox Lane was exposed that it had reported fake revenue and key metrics.

- Its mail order business became a costly legacy, while its offline retail stores did not generate any synergy with it EC business.

- It faced fierce competition from upcoming brands that also target at female shoppers.

- Mecox Lane (麥考林, NASDAQ: MCOX)

- 3C (computer, communication, consumer electronics)

- Newegg China (中國新蛋網)

- Founded by Taiwanese American Fred Chang in Los Angeles in 2001, Newegg achieved profitability from its first year, reached revenue of $1.3B in 2004, and had a annual retention rate of 70%. It was one of the first ECs to combine forum community and ecommerce online.

- The founder of JD was one of the suppliers for Newegg US back then. And the founder of Yixun, which is the next company I’ll introduce below, was the head of Newegg China.

- Fred Chang was quite conservative that he rejected VC funding and refused to provide much resource for Newegg China, even though Newegg China achieved $9M revenue in its first year in 2005. At the same time, JD had also pivoted to 3C focused EC, but it only achieved $1.5M revenue in 2005.

- It is not fair to say Newegg US is a failure. In fact, it claims to be the second largest B2C Ecommerce in US, although its GMV is less than one tenth of Amazon’s. On the other hand, Newegg China has already been forgotten by consumers.

- Major factors of failure (of Newegg China):

- 2005: Newegg prioritized its business in US.

- 2009: Although it had increased its investment in China market for a few years and even had a chance to beat JD, it decided to prioritize its IPO in US and cut down its capital support for Newegg China. Yet, its IPO in US was not realized.

- 2011: It once again tried to go public (and failed), and it didn’t allow Newegg China to grow without profitability.

- 2012~: The last three heads of Newegg China were always asking for resource and challenged Newegg US, but this new head arrived and chose to not ask for additional resource and not report any problem. As a result, Newegg China has been shrinking up to this date.

- Yixun (易迅網)

- Unable to get resource from Newegg US, the first head of Newegg China quite his job and started his own 3C focused Ecommerce in 2006. This China Internet unicorn continued to be the number three player in this field, behind JD and Newegg China, until it finally beat Newegg China in 2011 to become number two.

- Yixun never raised fund until 2010, when it received investment from Tencent. Tencent increased its stake gradually and finally acquired Yixun in 2012.

- However, even though Yixun was backed by Tencent’s capital and its users, it couldn’t surpass JD. In 2014, Tencent invested in JD and merged Yixun into JD. The founder of Yixun announced to leave the company.

- Major factors of failure (i.e. failed to beat JD)

- Yixun did not raise fund early on, while JD built out its logistics and marketing strategy with VC’s funding.

- Yixun’s founder, probably affected by Newegg’s founder, focused too much on profitability instead of growth.

- Yixun highly focused on a certain geographic area for a long time, while JD expanded to entire nation much earlier on.

- Newegg China (中國新蛋網)

China Internet Unicorn Conclusion:

- This article simply summarizes the stories of these failed startups and China Internet unicorn that were told in public. It might be more beneficial if you look deeper into one of these startups and learn from it.

- For upcoming articles, we will share more subjective analysis on these startups and our own lesson learned from these analysis.

- If you would like to help us improve these lists or get these lists in other formats, please “Like” our Facebook page and reach us at Facebook Messenger.

The Future Is Unwritten.