The Tragedies of Extravagant Funding and Immature Scaling

7 min read

Hi, I am Jonathan Hayashi. After graduating from University of Rochester with double degrees in Optical Engineering and Financial Economics, I worked in one of the top 3 investment banks in Japan, SMBC Nikko. Later on, I joined one of the largest VC firms in Japan, SBI, and took charge of growth stage investments in Blockchain, Fintech, and AI Sector. I joined Cornerstone Ventures in 2020.

China Unicorns Part I, Part II, Part III:

- For the full list of all the Chinese companies that became unicorns between 2014 and 2020, please go to Part I.

- For the analysis of famously failed vertical EC startups, please go to Part II.

- For this article, which would be Part III of this series, we will look into the examples of a counter-intuitive fact for most entrepreneurs: having too much funding early on is actually a bad thing!

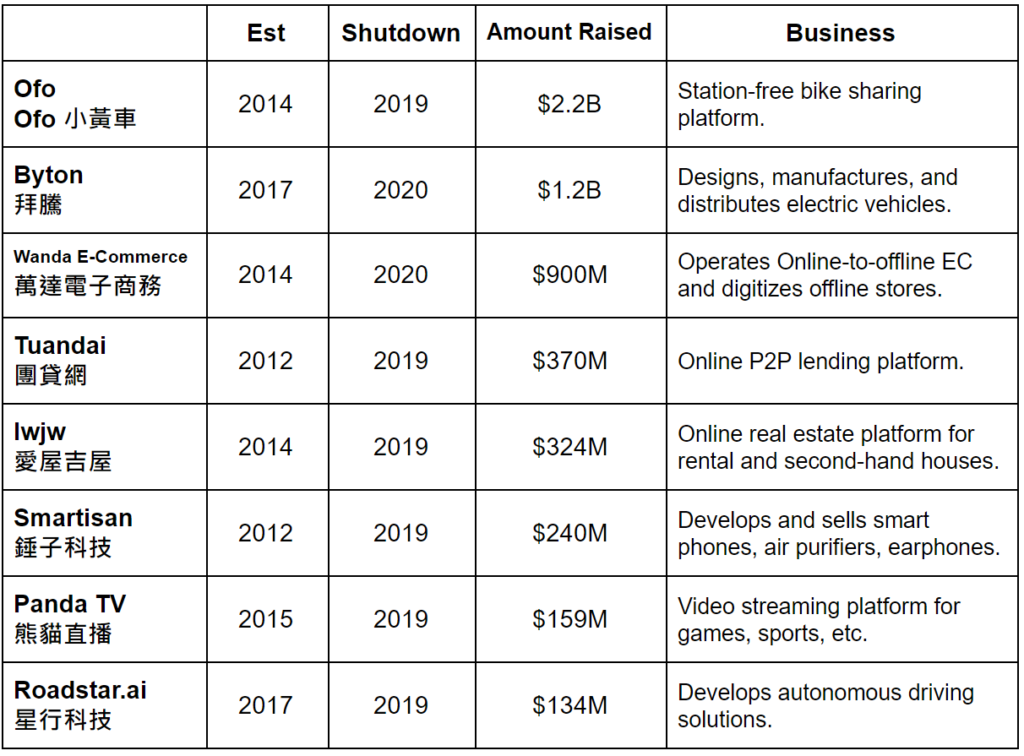

8 China Unicorns failed with abundant funding:

Addressing a common point of view:

- I have met many people in the startup scene who say the same thing about China:

- “There are tons of dumb money in China”;

- “Chinese VCs keep investing tons of money into buzzwords and trends”;

- “It takes too much capital to compete in China market, as all startups are burning tons of money to compete.”

- First of all, I think those observations about the China startup scene is, quite accurate.

- Second of all, however, those observations do not only apply to China, but also apply to markets where capital for private companies is abundant.

- Look at US: Isn’t Quibi shutting down 6 months after it raised $1.8B and went live?

- Look at Japan: Was Softbank Vision Fund’s investment in WeWork not “dumb money”?

- Look at India: Have you heard of Just Buy Live? It shut down 9 months after it raised $100M.

- Thus, whatever lessons we can learn from analyzing these failed Chinese startups, it should more or less also apply to you, even if you are not based in China.

Lessons from these failed China Unicorns, in cool phrases:

- “No matter how much you raise at your company you’ll end up spending it in 12~24 months” — Justin Kan, founder of Justin.tv and Twitch

-

-

- The exact reasons that lead to this outcome might be different every time:

- Maybe your competitors are deploying massive advertising campaigns, and you think you need to fight back.

- Maybe you find new products you can work on.

- Maybe your employees keep asking for a raise, otherwise they would leave.

- Maybe one of the VC board members keeps saying you are too conservative.

- But the outcome is the same, almost for every VC backed startup. So raising more cash does not significantly increase your cash runway.

- The exact reasons that lead to this outcome might be different every time:

-

- To complete a home-run, you have to pass the first base.

-

- No matter how many times you have hit a home-run before.

- In plain words, even if you were successful in your last startup, you still need to struggle this time to find your Product Market Fit, obtain your Early Adopters, adjust your Unit Economy, build out your Go-to-Market strategy, etc.

- You still need to pass these “first bases”, before you scale your business up.

-

- The more you raise early on, the harder you could raise later on.

-

- To break it down: The more you raise early on, the higher the valuation you need to set early on. The higher it is, the higher your shareholders will for the next round. And the higher it is, the harder you could find interested investors later on.

- From another angle: The more you raise early on, the higher the business milestone you need to set early on, and the lower probability for you to be able to achieve them.

- Constraints spark innovation.

- Why? Because innovation comes from thinking hard, countless trial & errors, and painful failures.

- If you don’t have constraints, what would motivate or incentivize you to go through those awful processes?

- Larger animals have slower reflexes.

- One of very few advantages that startups have against large enterprises, is how small the team can be and how efficiently everyone can communicate with each other.

- Don’t take me wrong. It’s a great thing for a startup to increase its headcounts quickly and significantly, but the question is when it should do so.

- Definitely not before it even launches its product.

- More money, more problems.

- Due to more stakeholders, and a higher stake.

- What’s the difference between a startup with lots of money and a large enterprise with lots of money?

- The startup does not have a definite plan to spend the money yet.

- So? So every stakeholder (VC, corporate investors, angel investors, management team, employees, customers) wants to argue on how to spend the money.

Like our Facebook page for more upcoming articles!

The Future Is Unwritten.